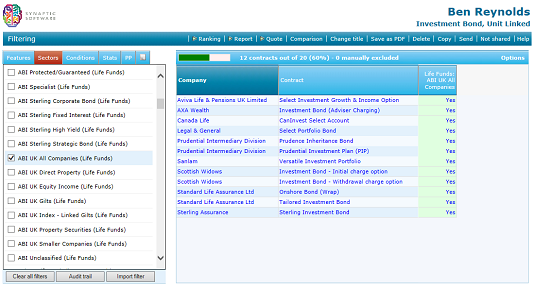

The Sectors tab shows all the sectors in which any of the contracts offers a linked fund.

The software offers a choice of two sectors definitions, FE or IMA/ABI/AIC. The latter provides the well-known but less detailed sector definitions. FE Global sector definitions offer extra detail, as described below.

Once you have made a choice of sector definitions, any other elements of the software that offer the same choice will be locked – e.g. you cannot use FE for sector choice and IMA for Fund Picker.

You simply tick all the sectors in which you intend to invest the client’s money. The system then removes any contracts which don’t offer funds in all those sectors – i.e. contracts are removed if they are unable to implement your recommended asset allocation.

In the example illustrated by the screenshot below, contracts are being eliminated unless they offer a UK All Companies fund.

Marking sectors as declined

Sectors can be marked as declined, just like contract features – again, you click the right mouse button over the field name and choose the Decline option.

This is mostly intended for use by compliance officers in preset criteria. If sectors are marked as declined and the presets are locked, the adviser then cannot filter and rank on those sectors.

Filtering on ethical funds

The list of contract features includes an entry for Ethical Funds (illustrated by the screenshot below). Clicking on this eliminates any contracts which do not offer at least one ethical fund.

In addition, choosing ethical funds also has the following effects (as described in the message box in the screenshot):

- The list of sectors is trimmed down so that it only shows those sectors in which any of the contracts offers an ethical fund.

- If you select a sector, contracts will be eliminated unless they offer an ethical fund in that sector.

- Past performance calculations in the ranking stage are changed so that only ethical funds are taken into account.

Filtering on MoM and FoF funds

The list of contract features also includes options for manager-of-managers and fund-of-funds. These are not treated in the same way as the ethical option. Choosing MoM (or FoF) eliminates contracts which don’t offer a MoM (or FoF) fund, but doesn’t modify the list of sectors, and doesn’t change the basis of past performance calculations.

The reason for this is as follows:

If a client is interested in ethical investments, then they will only be prepared to invest in ethical funds. Therefore, the system effectively removes everything other than ethical funds from consideration.

If the adviser is recommending MoM/FoF, then they will nevertheless be prepared to invest in non-MoM/FoF funds wherever they clearly provide a better alternative. It’s not the same black-white category of decision as ethical investment, and therefore MoM/FoF are not treated in the same restrictive way.