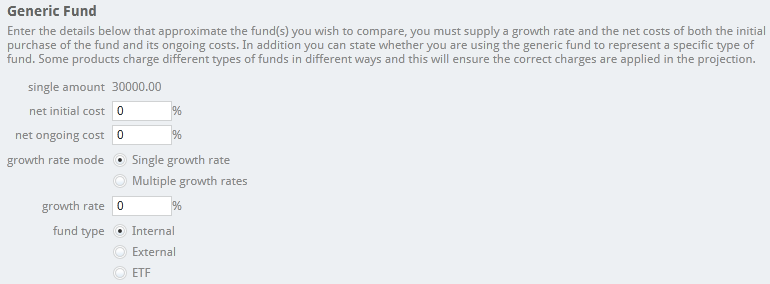

When making a fund selection you will be able to bypass the need for a portfolio and apply the same fund costs across all products.

You will need to define the net initial and on-going costs of the fund & the growth rate the fund has. It is possible to specify a growth rate for the Generic Fund to be a negative. You will also need to select what type of fund they are representing (internal, external or ETF).

The projection will use the figures supplied across all the products in the comparison.

Some providers have specific charges for different fund types and this will ensure the correct charges are applied to the projections.

The use of the generic fund will not filter out any providers.

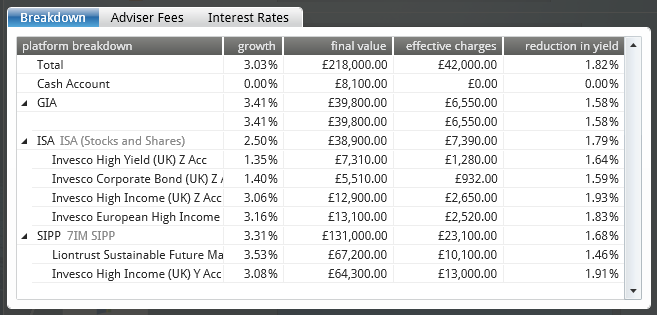

As seen in the screenshot below, we have used generic fund under the GIA area. You will see the growth rate, final value, effective charges and RIY based on the figures you have entered. If using a portfolio, you will see the figures broken down under each product by fund: