The Product comparison section of the tool allows you to compare the total charges for on and off platform drawdown products to help you decide the most appropriate product to place your clients’ drawdown investment.

All the products that appear within the drawdown comparison have had the charges supplied to us by the providers with the output that the tool produces being ‘signed off’ by the providers to say that the results are acceptable.

The product comparison input page is only visible if you have skipped the income analysis section of the tool and have come straight to product comparison from the Analyser welcome page.

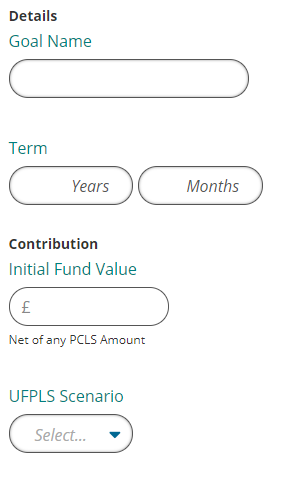

Goal Name - the goal name needs to be unique, this will save back to the Retirement goals section of the client screen.

Term – this is the how long you would like the drawdown projection to run

Initial Fund Value – this is the amount of money going into the drawdown plan at the start of the plan. This figure needs to be net of any PCLS taken

UFPLS Scenario – the product comparison allows both PCLS and UFPLS scenarios, some providers may have additional charges associated to UFPLS withdrawals. These charges will be taken into account in any calculations if UFPLS is set to ‘Yes’.

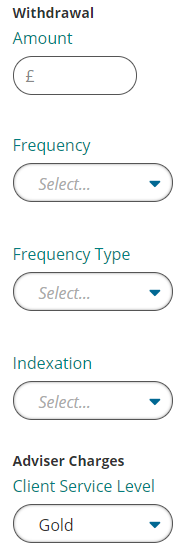

Withdrawal Amount – only level withdrawals can be input. If you need to detail a profiled income you will need to do that in the Income Analysis section.

Frequency – you can choose from monthly, quarterly, half yearly or annually. This determines how frequently the withdrawal happens and when that needs to be applied in the calculations.

Frequency type – either advance or arrears, this determines at what point during the frequency the withdrawal is taken and when that needs to be applied in the calculations.

Indexation – This can be set to RPI, CPI, AWE, or a manual value. This will increase the withdrawal annually by the chosen amount.

Client service level – the client service level is pre-populated if one has been previously input against the client. If not, manual values can be input; this is then used to add adviser charges against the product comparison.

You can now move onto the filtering screen.