The Sectors tab shows all the sectors in which any of the contracts offers a linked fund.

Synaptic offers a choice of two sector definitions, FE (Financial Express) or IMA/ABI/AIC. The latter provides the well-known but less detailed sector definitions. FE Global sector definitions offer extra detail.

Once you have made a choice of sector definitions, any other part of the software that offers the same choice will be locked for this piece of research - i.e. you cannot use FE for sector choice and then IMA for fund picker.

You simply tick all the sectors in which you intend to invest the client's money. The system then removes any contracts which don't offer funds in all the selected sectors - i.e. contracts are removed if they are unable to implement your recommended asset allocation.

If Sectors have not been discussed with the client, then this area does not need to be used and can simply be skipped over.

Marking sectors as declined

Sectors can be marked as declined, like contract features. To mark a sector as declined, right click on the sector name and select Decline from the pop up menu.

Filtering on ethical funds

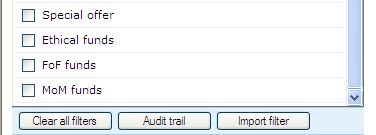

The list of Contract features includes an option for Ethical Funds:

Selecting the feature will eliminate any contracts which does not offer at least one ethical fund.

Selecting this feature will also affect the following:

- If you select a sector, contracts will be eliminated unless they offer an ethical fund in that sector.

- Past performance calculations in the ranking stage are changed so that only ethical funds are taken into account.

Filtering on MoM (Manager of Manager) and FoF (Fund of Funds) Funds

The list of contract features includes options for MoM and FoF:

These are treated in the same way as the ethical option. Selecting MoM or FoF eliminates contracts which do not offer a MoM or FoF fund, but does not change the basis of past performance calculations. The reason for this is as follows:

If a client is interested in ethical investments they are only prepared to invest in ethical funds. Therefore, the system removes everything other than ethical funds from consideration.

If the adviser is recommending MoM/FoF, then they will nevertheless be prepared to invest in non-MoM/FoF funds wherever they clearly provide a better alternative. Is is the not the same black and white category of decision as ethical investment and therefore MoM/FoF are not treated in the same restrictive way.