Other income gives you the opportunity to add details of any other income sources that you would like the system to take into consideration when determining how to meet the income profile along with calculating the tax liability for the scenario. For phased drawdown, there is a requirement that one additional other income is included along with state pension before progressing.

State pension is included as part of other income. To take it out of the calculations, untick the selection box. The state pension age is auto-calculated from the age and gender of the client using Office of National Statistics data; this can be changed if desired. The yearly income amount can be amended to your client’s specific circumstances.

If your client has earned additional state pension then this figure can also be taken into consideration when calculating the income analysis. This number must be manually input.

Other income gives you the ability to add as many additional sources of income that you need to be considered during the income analysis.

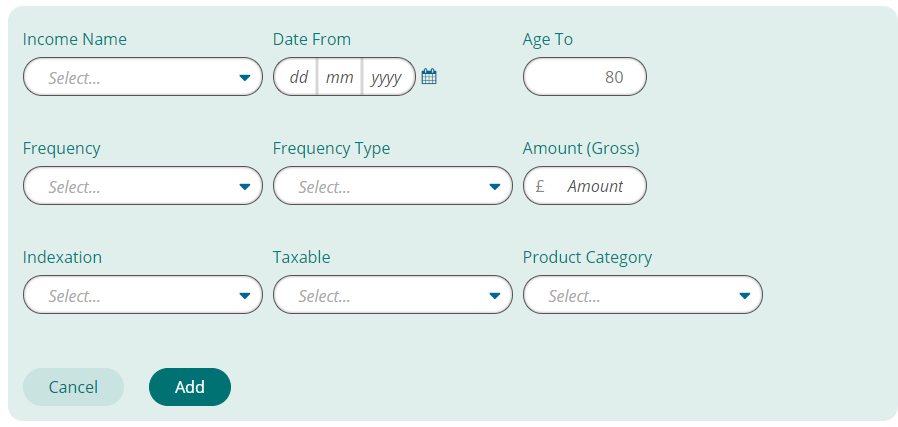

Income Name – this will list all previously entered income source from the holdings area for this client, alternatively add other income sources manually.

Date From – this is the date you need the other income to start.

Age To – this is the age at which the other income is to cease within the income analysis calculations.

Frequency – How often the income source is paid to the client, can be monthly, quarterly, half yearly or annually.

Frequency Type – can be either advance or arrears.

Amount – this is the amount of income paid at each frequency.

Indexation - RPI, CPI, AWE, or a manually input escalation rate can escalate the other income amount.

Taxable – is the other income input taxable or non-taxable. This information is used when calculating the income needed to achieve the income profile

Product Category – this dropdown is to classify the other income and is surfaced in any reports generated.