Modeller allows you to add client holdings in the holdings area and allows these holdings to be allocated to goals which the client may have. Note that it is only possible to allocate a complete holding towards a desired goal.

There are two ways to add holdings; either select the Holdings tab on the left hand side of the menu:

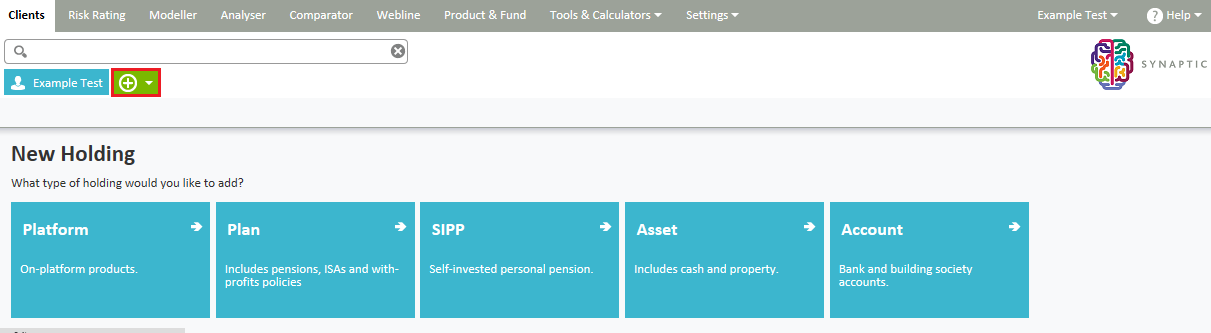

Or select the + sign next to the client’s name and then select the holding type you would like to add:

You can record details of Platforms, SIPPs, Plans, Assets and Accounts against the client as shown below:

All holding types work the same way; you can add a new holding type by selecting the blue add button on the right hand side. Here you also find options for reporting on, copying, editing and deleting the holding if the holding type has been added.

Depending on the holding type, you will get a selection menu on the left had side for Details, Contributions, Withdrawals, Underlying Assets and Performance.

Platforms and SIPPs

Both the Platform and SIPP sections can hold details of client’s Assets, Accounts and/or Plans relevant to that SIPP and/or Platform.

In addition, under Platforms you can also record client’s SIPP details.

Plans

Enter any relevant products the client has under the Plans section, e.g. ISAs. You can add and edit plan Details and record contract numbers, which can be used for contract enquiry in the future. You can select whether the holding can be Rebalanced, Augmented and/or Transferred.

In the Contributions Tab, you can record the amount currently being paid to any holdings by clicking on the ‘add’ button.

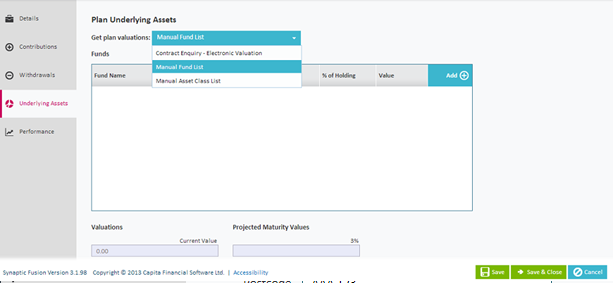

You can also record any withdrawals in the Withdrawals tab. Underlying Assets can be manually entered as asset classes or you can manually select funds.

The Performance tab displays plan performance over a period of time using data points. Data points are picked automatically whenever a new valuation has been entered into the system either manually or via contract enquiry. Please note that there can only be one data point per day.

Assets

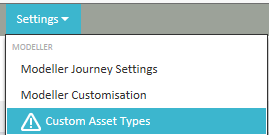

You can record client assets in the Assets section, e.g. property. You can record asset purchase date, net value, income and income frequency. Please note that you (or a firm Administrator) may need to add Custom Assets on the Settings tab unless these have been already been set at a firm level.

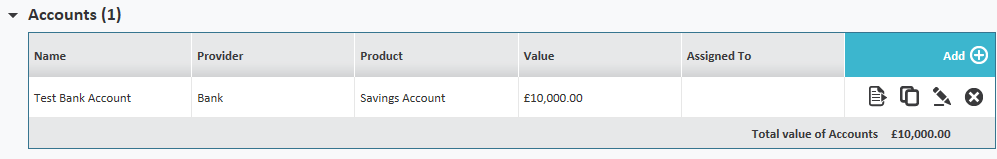

Accounts

The Account section allows you to record account details and current value together with interest rates for the account.