The add plans screen is where you can select previously input plans from the holdings area, add new plans, project values, and select the income strategy you would like to model.

From the add plans screen you have access to three of our financial calculators to help you determine the value of your plans when the client is going into drawdown. For more information on how to use each calculator, please refer to the calculators user guide.

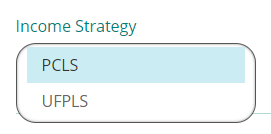

The system allows you to choose two income strategies, either PCLS or UFPLS. If you select PCLS the system will take out the percentage of PCLS specified and remove it from the income calculations.

UFPLS will keep the total plan values invested in the drawdown plan, when income is taken from the drawdown plan 25% of the income withdrawn will be tax free, this will be taken into account when calculating the tax liability.

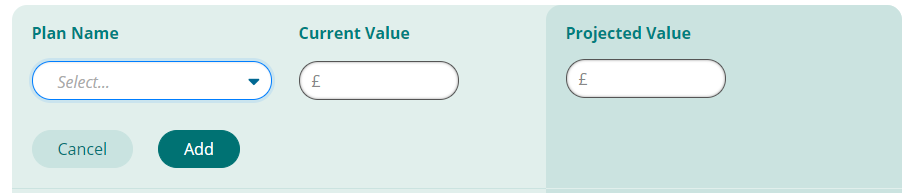

The plan name dropdown allows you to select a plan that has been previously input in the clients holding screen, alternatively you can input a new plan by choosing the ‘Add new plan’ from the dropdown choices.

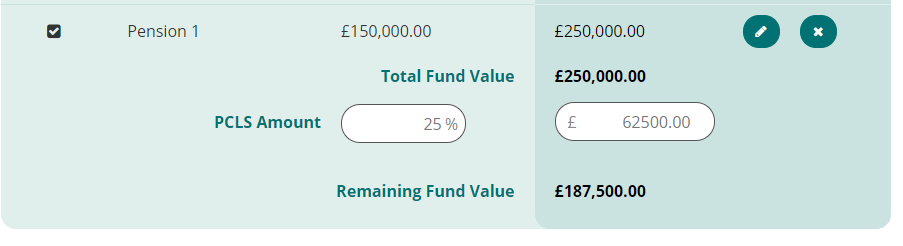

You can add as many plans as you would like to take into the drawdown scenario. The projected total value of all plans is calculated. If you have chosen a PCLS income strategy then you can specify how much PCLS out of the total you would like to remove. The system defaults to the 25% tax-free amount. However, this can be overwritten up or down to suit your clients’ needs.

The remaining fund value will be the figure used for the drawdown plan ‘initial investment’ when calculating if your income profile is achievable for the duration specified.