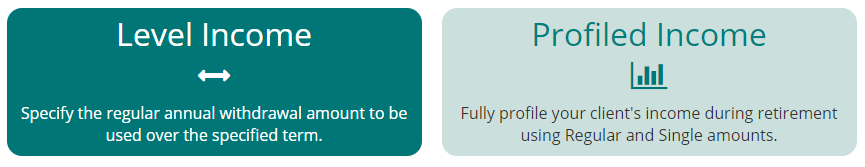

There are two options for income requirements. These are a Level Income or a Profiled Income.

Level Income – if this option is chosen, then the annual figure specified will be assumed to be payable monthly in advance, with no escalation associated to it.

Profiled Income – this option allows you to specify:

Regular income needs between specific ages i.e. from age 67 to age 81, I will have living expenses and bills

Single amounts at a specific age i.e. at age 70, I will need a new car.

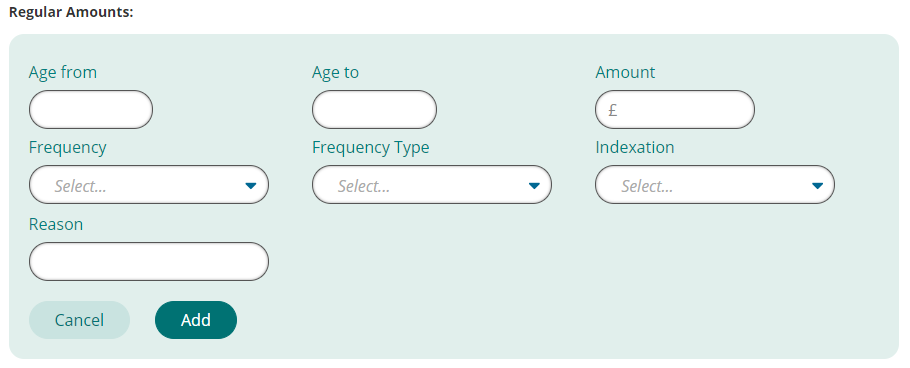

Profiled income has additional options to help build the income profile. Each regular amount is required to have:

Age from and to – this is so that the system knows when to withdraw from the drawdown fund and when to stop the withdrawals.

Amount – the amount for each withdrawal.

Frequency – the frequency can be monthly, quarterly, half yearly, or annually.

Frequency Type – specifies whether it is advance or arrears, this determines whether the withdrawal should happen at the start or the end of the period.

Indexation – RPI, CPI, AWE, or a manually input escalation rate can escalate the withdrawal amount annually.

Reason – this is not mandatory but will show on any reports generated as a reference.

26/12/2018