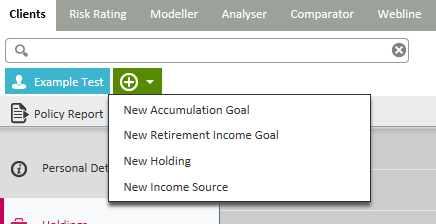

To start a modelling session, you need to record an accumulation goal for your client. To record a new goal, you have the option of either using the New Action button (as shown below) at the top of the screen or clicking on the Accumulation Goal tab on the left of the Client screen.

Choose New Accumulation Goal and the following screen appears:

The fields with a * need to be completed. All other fields are optional.

- Choose the Goal Type. Either your Client is looking for a lump sum or an Income.

- Enter the Goal Name.

- Confirm either the Target Value £ or Target Annual Income.

- Enter the Review Date. This is the date that you will next review this goal and it defaults to one year.

- Record the Term in years. (Minimum term is one year).

- Enter Total Solution Cost % (Annually). This is the total solution cost to include all charges associated such as product/fund/platform and your charges calculated on an annual basis.

- If known and relevant, enter the Initial Contribution £.

- If known and relevant, enter the Regular Contribution £.

- Confirm Contribution Frequency and Indexed (if relevant). The Indexation figures are updated monthly.

- For the first Investment Basis box - choosing Balanced – assumes that re-balancing is done at the end of the year on the different asset classes. Non- balanced assumes that no asset class re-balancing will be carried out.

- Target Basis box confirms if a nominal or real value is required. A Real illustration adjusts the nominal value to reflect the effects of inflation over time and includes this within the projected value.

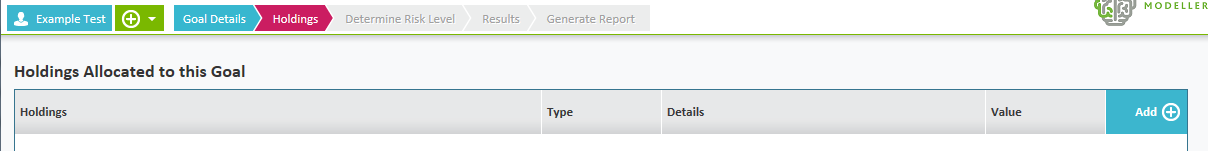

Once the details have been set, select Next. The following Holdings screen will display:

Click Add on the top right hand side of the screen and this will allow you to assign selected existing holdings to the goal specified.

You will then be presented with the following screen, which displays this list of existing holdings. In order to assign any holdings, tick the box on the left hand side applicable to the relevant holding. There is also a warning triangle which indicates the validity of holdings, where the underlying asset in the holding does not contain the required information for Modeller to be able to use it.

Once you have completed your selection click add at the bottom of the screen.

The holdings are set up in the Holdings area as specified.

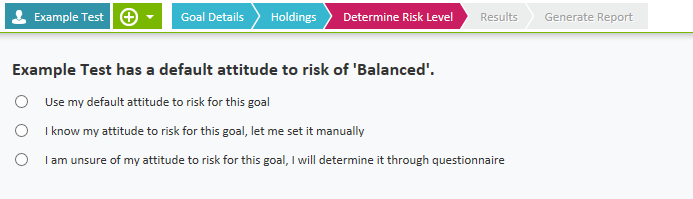

Once all completed, use the Next button to move to the next page. The following will now be

displayed:

Select if the default ATR is to be used, whether it is to be set up manually or a new ATR is to be calculated for this goal and click the Next button. If client’s ATR was not set up in Personal Details, you have the option to set it against the goal.

If “I know my attitude to risk for this goal, let me set it manually” is selected, a new page will be displayed with the options to manually set the client’s ATR. If this is selected, when moving on to the next screen, you will be prompted to add a reason why ATR was manually set.

If “I am unsure of my attitude to risk for this goal, I will determine it through questionnaire” is selected, a new page will be displayed with the questionnaire to answer the questions to calculate the ATR once the Next button has been clicked.

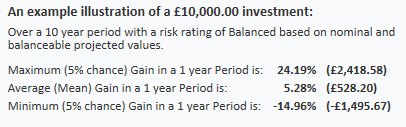

You will then be presented with an asset allocation split for the proposed Goal. This is reflected in the ‘donut’ graph on the right hand side. There is also information displayed which gives details of an investment of £10,000 within a balanced ATR (these figures will change dependent on the ATR set against the goal).

This shows the potential maximum and minimum gains in a 1 year period with a once in twenty year occurrence.

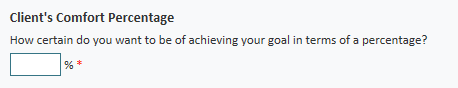

Client’s Comfort Percentage question is a mandatory field to fill in before moving on:

Modeller needs to know how important it is to the client of achieving the target goal in percentage terms. This is a mandatory field and thus must be filled in before proceeding.

Examples of this are as follows:

Example 1

I want £10,000 in 5 years’ time to buy a new car and am willing to save £100pm to achieve this. My client comfort percentage is 30% - if in 5 years the investment isn’t worth £10,000 I will just keep saving until it is.

Example 2

I need £15,000 in 10 years to pay for my son’s first year of university fees. I am willing to save £100.00 pm to achieve this. My client comfort percentage is 90% - I need to have the £15,000 in 10 years.

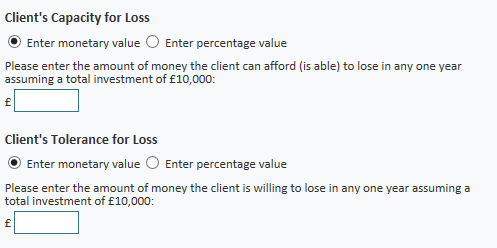

Modeller also gives the opportunity to record Client’s Capacity for Loss and Client’s Tolerance for Loss:

However these are not mandatory fields.

To move onto the next page, use the Next button in the bottom right hand corner.

Modeller will now display the chosen scenario in graphical terms in the so called £10K screen. This screen shows you the probability of the goal being achieved assuming a £10,000 lump sum investment. You can model different scenarios and display up to three scenarios for side by side comparison.

You can change the graph type at the top of the screen to choose the best way to illustrate the probability for your client.

You can select to implement this scenario by ticking the radio button at the bottom of your selected scenario.

When clicking next, Modeller will ask whether you wish to rebalance holdings now or skip directly to the report generation.

For report options, you can select the information you wish to be displayed in the report. The report will automatically show the manual ATR reason if this was selected as well as a closing statement if you wish to add one in. Click next to generate the report.

Please note that the report will open up as a PDF and you can now save this onto your client records outside of Modeller.

[SM1]The ATR changes dependent on the ATR for the goal not always balanced